limited pay life policy example

As a general rule of thumb fewer years results in a. When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition.

How To Find The Best Life Insurance Policy For You By Tenderfolks2749 Issuu

However Term has no cash value so.

. Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life. A Limited-Pay Life policy has.

A limited pay whole life policy is a permanent insurance policy guaranteed to be fully paid-up at a certain date or when you reach a certain age with no. Paid Until Age 65. Examples of limited pay life insurance policies include.

Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life. A limited pay insurance policy is a type of permanent life insurance product sometimes called whole life in which the policyholder pays premiums over a set period of time or until a specific. 7-pay life insurance life paid up to 65 and.

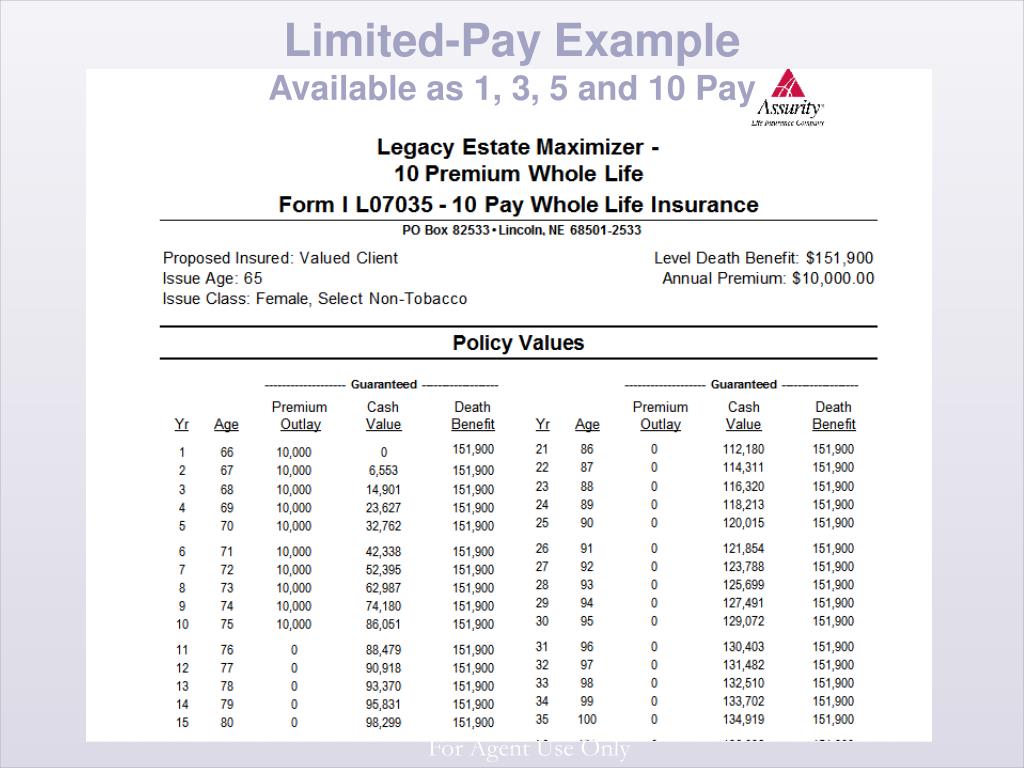

Which is an example of limited pay life policy. While there are several types of policies that meet the limited pay definition the most common types of limited pay policies issued today are. The 10 pay the 7 pay the 15 pay the 20 pay the 30 pay and the Paid at 65 life policy but not a term life insurance plan.

Graded death benefitsno cash valuepremium payments limited to a specified number of yearspremium payments that are paid to age 100. Because limited pay policies have fewer premiums to reach paid-up status they need more significant premiums yearly than continuous pay insurance policies. The following examples show what a single pay limited 7-pay and traditional whole life policy might look like for a 45-year old male applying for 1000000 in coverage.

John is a 45-year-old male. The most common options include. Limited pay life policy example.

What is an example of a limited pay policy. Premiums are usually paid over a period of 10 to 20. Limited premium payment plans are term life insurance plans which allow you to pay premiums for a limited tenure while your coverage.

What Is an Example of a Limited Pay Life Policy. Lets start by looking at the different payment terms. A limited-pay life policy requires the policyholder to pay premiums for a limited number of years but its coverage last a lifetime.

All whole life insurance is designed to reach maturity at the insureds age. Annual payments for a limited pay life policy will depend on your age at enrollment and your coverage amount. Updated July 27 2017.

For example limited life.

Limited Pay Whole Life Insurance Choosing A Policy Paradigmlife Net Blog

What Is Limited Pay Life Insurance Policyadvisor

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates

Best Whole Life Insurance Companies Of October 2022 Forbes Advisor

Best Life Insurance Companies Of 2022 U S News 360 Reviews

What Are The Principal Types Of Life Insurance Iii

Cash Value And Cash Surrender Value Explained Life Insurance

Paid Up Additions The Magic Of Cash Value Life Insurance The Insurance Pro Blog

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates

Common Mistakes In Life Insurance Arrangements

Surrender A Universal Life Insurance Policy Wealth Management

9 Types Of Life Insurance Forbes Advisor

Limited Pay Whole Life Insurance Is It Your Best Choice Wealth Nation

Comprehensive Guide For Buying A Limited Pay Life Policy

Which Of The Following Is An Example Of A Limited Pay Life Policy Quickquote

Limited Pay Whole Life Insurance What Is It See The Numbers

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference